Uk Vat Rate On Furniture . Some things are exempt from vat, such as postage stamps and some financial and. The standard rate of vat increased to 20% on 4 january 2011 (from. Check the vat rates on different goods and services. Some goods and services are subject to vat at a reduced rate of 5%. The uk government has established three main vat rates: The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. The reduced vat rate is 5% — this applies to goods. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The default vat rate is the standard rate, 20% since 4 january 2011. It applies to most goods and services. The standard vat rate in the uk, currently set at 20%, applies to most goods and services. The standard vat rate is 20%. The registration limit is £90,000.

from www.gov.uk

The registration limit is £90,000. The standard rate of vat increased to 20% on 4 january 2011 (from. Check the vat rates on different goods and services. The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. Some goods and services are subject to vat at a reduced rate of 5%. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The standard vat rate in the uk, currently set at 20%, applies to most goods and services. It applies to most goods and services. Some things are exempt from vat, such as postage stamps and some financial and. The reduced vat rate is 5% — this applies to goods.

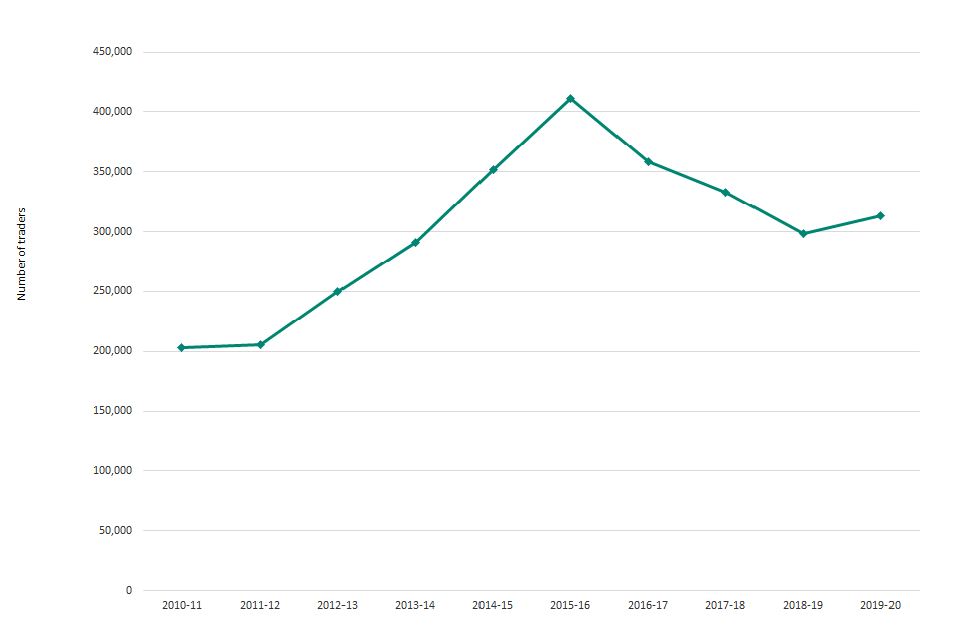

Annual UK VAT statistics 2019 to 2020 commentary GOV.UK

Uk Vat Rate On Furniture Check the vat rates on different goods and services. The standard vat rate is 20%. The standard vat rate in the uk, currently set at 20%, applies to most goods and services. The default vat rate is the standard rate, 20% since 4 january 2011. The uk government has established three main vat rates: It applies to most goods and services. The registration limit is £90,000. The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. Check the vat rates on different goods and services. The standard rate of vat increased to 20% on 4 january 2011 (from. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The reduced vat rate is 5% — this applies to goods. Some goods and services are subject to vat at a reduced rate of 5%. Some things are exempt from vat, such as postage stamps and some financial and.

From yourecommerceaccountant.co.uk

Amazon Seller A Complete Guide to UK VAT Accountant Help Uk Vat Rate On Furniture The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. Check the vat rates on different goods and services. It applies to most goods and services. The standard rate of vat increased to 20% on 4 january 2011 (from. The registration limit is £90,000. Some things are exempt from vat, such as. Uk Vat Rate On Furniture.

From hellotax.com

VAT rates in Europe Definition, Actual ValueAddedTax Rates hellotax Uk Vat Rate On Furniture The standard vat rate in the uk, currently set at 20%, applies to most goods and services. The standard vat rate is 20%. Some things are exempt from vat, such as postage stamps and some financial and. The default vat rate is the standard rate, 20% since 4 january 2011. It applies to most goods and services. The uk government. Uk Vat Rate On Furniture.

From exceldatapro.com

Download UK VAT Invoice With Discount Excel Template ExcelDataPro Uk Vat Rate On Furniture The default vat rate is the standard rate, 20% since 4 january 2011. The standard vat rate is 20%. The standard vat rate in the uk, currently set at 20%, applies to most goods and services. Check the vat rates on different goods and services. The standard rate of 20%, the reduced rate of 5%, and the zero rate of. Uk Vat Rate On Furniture.

From www.youtube.com

How to Calculate UK VAT (Value Added Tax) UK vat explained YouTube Uk Vat Rate On Furniture The standard vat rate is 20%. The default vat rate is the standard rate, 20% since 4 january 2011. Some goods and services are subject to vat at a reduced rate of 5%. Check the vat rates on different goods and services. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The reduced. Uk Vat Rate On Furniture.

From www.rydoo.com

How Can UK Companies Manage With Four VAT Rates? Rydoo Uk Vat Rate On Furniture The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. The standard rate of vat increased to 20% on 4 january 2011 (from. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. It applies to most goods and services. Some things are exempt from vat,. Uk Vat Rate On Furniture.

From cruseburke.co.uk

How Much is Value Added Tax in the UK? CruseBurke Uk Vat Rate On Furniture The registration limit is £90,000. Some things are exempt from vat, such as postage stamps and some financial and. Some goods and services are subject to vat at a reduced rate of 5%. The default vat rate is the standard rate, 20% since 4 january 2011. The standard vat rate is 20%. Check the vat rates on different goods and. Uk Vat Rate On Furniture.

From taxually.com

Taxually UK VAT Rate All You Need to Know for 2023/24 Uk Vat Rate On Furniture The registration limit is £90,000. Some things are exempt from vat, such as postage stamps and some financial and. The uk government has established three main vat rates: Check the vat rates on different goods and services. The reduced vat rate is 5% — this applies to goods. The standard rate of vat increased to 20% on 4 january 2011. Uk Vat Rate On Furniture.

From www.freeagent.com

UK VAT rates and thresholds 2022/23 FreeAgent Uk Vat Rate On Furniture The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. The reduced vat rate is 5% — this applies to goods. The uk government has established three main vat rates: The standard rate of vat increased to 20% on 4 january 2011 (from. Some things are exempt from vat, such as postage. Uk Vat Rate On Furniture.

From www.freeagent.com

What needs to be on a UK VAT invoice? FreeAgent Uk Vat Rate On Furniture Check the vat rates on different goods and services. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The default vat rate is the standard rate, 20% since 4 january 2011. It applies to most goods and services. Some things are exempt from vat, such as postage stamps and some financial and. The. Uk Vat Rate On Furniture.

From blog.siliconbullet.com

UK Flat Rate VAT Scheme Changes From April 2022 Uk Vat Rate On Furniture The standard vat rate in the uk, currently set at 20%, applies to most goods and services. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The registration limit is £90,000. Some things are exempt from vat, such as postage stamps and some financial and. The uk government has established three main vat. Uk Vat Rate On Furniture.

From limbodivision209.com

UK VAT rate explains LimboDivision209 Uk Vat Rate On Furniture The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. The standard vat rate is 20%. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. Some goods and services are subject to vat at a reduced rate of 5%. The registration limit is £90,000. The. Uk Vat Rate On Furniture.

From www.gov.uk

Quarterly VAT statistics commentary (October to December 2020) GOV.UK Uk Vat Rate On Furniture The default vat rate is the standard rate, 20% since 4 january 2011. It applies to most goods and services. The uk government has established three main vat rates: The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. The standard vat rate is 20%. The registration limit is £90,000. Some goods. Uk Vat Rate On Furniture.

From www.oneeducation.org.uk

Essentials of UK VAT One Education Uk Vat Rate On Furniture The reduced vat rate is 5% — this applies to goods. Some goods and services are subject to vat at a reduced rate of 5%. The standard rate of vat increased to 20% on 4 january 2011 (from. The standard vat rate in the uk, currently set at 20%, applies to most goods and services. The uk government has established. Uk Vat Rate On Furniture.

From calculatethevat.com

Understand VAT Rate in the UK An EasytoUnderstand Guide Uk Vat Rate On Furniture Check the vat rates on different goods and services. The uk government has established three main vat rates: The default vat rate is the standard rate, 20% since 4 january 2011. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The current vat rates in the uk are 20% standard rate, 5% reduced. Uk Vat Rate On Furniture.

From www.europarl.europa.eu

Tax policy EU solutions to prevent tax fraud and avoidance Topics Uk Vat Rate On Furniture Some things are exempt from vat, such as postage stamps and some financial and. The standard rate of 20%, the reduced rate of 5%, and the zero rate of 0%. The reduced vat rate is 5% — this applies to goods. The registration limit is £90,000. The current vat rates in the uk are 20% standard rate, 5% reduced rate. Uk Vat Rate On Furniture.

From adamaccountancy.co.uk

How much is vat in UK What You Need to Know Uk Vat Rate On Furniture Some things are exempt from vat, such as postage stamps and some financial and. The registration limit is £90,000. The standard vat rate in the uk, currently set at 20%, applies to most goods and services. The standard rate of vat increased to 20% on 4 january 2011 (from. The reduced vat rate is 5% — this applies to goods.. Uk Vat Rate On Furniture.

From calculatethevat.com

UK VAT Calculator Say Goodbye to Complexities! Uk Vat Rate On Furniture Some goods and services are subject to vat at a reduced rate of 5%. The registration limit is £90,000. Some things are exempt from vat, such as postage stamps and some financial and. The uk government has established three main vat rates: The default vat rate is the standard rate, 20% since 4 january 2011. The standard rate of vat. Uk Vat Rate On Furniture.

From www.fkgb.co.uk

UK Tax Allowances and Tax Rates for 2022/23 Tax Year and Future Years Uk Vat Rate On Furniture The current vat rates in the uk are 20% standard rate, 5% reduced rate and 0% zero rate. Check the vat rates on different goods and services. Some goods and services are subject to vat at a reduced rate of 5%. The standard vat rate is 20%. It applies to most goods and services. The registration limit is £90,000. The. Uk Vat Rate On Furniture.